The New New Deal

Building the economic infrastructure for a new era of self-employment

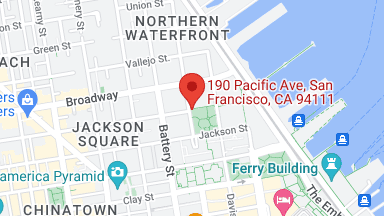

Obvious |

The secular shift toward self-directed employment continues unabated. Startups and investors have an opportunity to address the emergent needs of this new working class—or risk missing out on a tremendous value creation opportunity.

The COVID-19 pandemic was a reckoning for employees, employers, and the relationship between them. Without the traditional indulgences of knowledge work—in-person relationships, IRL team bonding activities, and, to a certain degree, agency—we’ve been left alone to stew in our own identities.

Such introspection has left millions, particularly Millennials and Gen Z, rethinking their motivations and direction, particularly in the context of work. They’re seeking closer interpersonal relationships, a heightened sense of purpose, and a reorientation towards more fulfilling goals, which is increasingly taking the form of self-directed employment. The U.S. is, consequently, already seeing a dramatic uptick in resignations, with 40% of the workforce exploring the possibility of leaving their existing employer this year.

This shift should be celebrated for enhancing societal satisfaction, yet it does come with a steep cost. Workers are increasingly forgoing employer-sponsored support systems as they transition towards more self-directed initiatives. Do they understand that such benefits can account for more than 30% of their traditional compensation? That they are often the determining factor in avoiding an unexpected medical expense, being able to pay down student debt, or even being eligible for a mortgage? As more people wave goodbye to 9-to-5 roles, there remains an extraordinary market opportunity to meet them where they are headed.

To address the emerging needs of the new employment era, we at Obvious foresee the demand for an up-leveled suite of portable, interoperable benefits that empower a modern workforce with the structure, simplicity, and support of today’s corporate cushions.

1. Tax Management & Accounting

While many dream of the autonomy and agency associated with self-directed work, few are prepared for the tax and accounting realities. While the market is currently seeing accelerating adoption of online banking, cloud-based accounting, and tax management software by independent workers, many businesses-of-one are still left patching together disparate DIY offerings. This leads to high degrees of redundancy and low levels of cross-functional automation. From calculating quarterly tax liabilities to optimizing deductions, back-office management for independent workers can tornado into a full-time job of its own.

As today’s businesses-of-one continue to evolve in complexity, they’ll need centralized, automated, interoperable, and easy-to-understand tax and expense management software so they can focus their attention on what matters most—their work. Integrations with third-party applications, ranging from Shopify and Stripe to Venmo and QuickBooks, will be critical in simplifying an operation’s financial foundation and minimizing a small business’ cost and complexity. From Collective, an end-to-end platform managing company formation, taxes, accounting, and compliance for self-employed individuals, to Found, a full-stack business banking application with features like tax management recommendations and bookkeeping, we’re already seeing new entrants begin to establish themselves as the trusted operating system for this $1.2 trillion industry.

- Will legacy financial services providers up-level their existing offerings, or will new entrants with nimbler tech stacks, interoperable data engines, and resonant brands take hold?

- Will AI-enablement and increasing automation allow next-generation providers to make smart recommendations that cross seamlessly between personal and professional profiles as consumers adopt a more holistic approach to financial management?

- And with robust real-time data reflecting the health, seasonality, and working capital dynamics of a given business, what ancillary features might tax and accounting platforms offer as they grow?

2. Access to Credit

While U.S.-based freelancers earned $234 billion in 2020, 70% of independent workers still live paycheck to paycheck and experience material revenue volatility. This creates roadblocks to accessing credit, a key Achilles heel of the freelancer / gig economy today given our nation’s dependence on debt to fuel growth. Accordingly, as solopreneurs’ personal credit scores have become an important proxy for their trustworthiness in the eyes of lenders, a reported 70% of small business owners lack access to funding. Why? Because without an employer-generated paystub or W-2 form, it can be seemingly impossible for freelancers to prove their forward earnings potential. Furthermore, as many businesses-of-one seek to minimize their reported income in an effort to prune their end-of-year tax liabilities, few are able to establish a strong FICO score, the magic number that unlocks access to financing options like corporate credit cards, business loans, personal lines of credit, and home mortgages.

We need advanced analytics engines that incorporate disparate data to form a holistic financial profile and automated credit decision engines to transform the financial services offerings for the 51 million Americans engaged in self-directed work today. We’ve already witnessed new entrants emerge to fill the gaps, including Lean, a financial services provider tailor made for independent, hourly, and gig workers, and Karat, a better banking system designed specifically for digital creators.

- Will the emerging wave of digitally-native financial services providers displace banks as their de facto financing source, or will existing players leverage robust consumer data sets and the growing spectrum of embedded solutions to offer direct access to credit for their captive audiences?

- As our data inputs expand beyond wages and hours worked, will we see a broadening base of credit worthiness measurements that better reflect the variability and complexity of today’s earnings environment?

- And might data-driven decision-making and revised documentation initiatives help level the playing field for historically underbanked demographics as they too seize the opportunity to expand beyond the traditional employment ecosystem?

3. Financial Planning & Retirement

Perhaps unsurprisingly, independent workers report significantly higher levels of economic anxiety. Accordingly, labor analysts have expressed concern surrounding the longer-term economic consequences of self-directed work, particularly in the context of savings and financial planning. Independent workers are much less likely to have formal saving / retirement plans and don’t benefit from employer contributions or the broad base of behavioral “nudges” that drive participation in workplace retirement programs. In fact, studies have indicated that contingent workers are two-thirds less likely than traditional workers to have a work-related retirement plan. While some blame lower participation rates on the smaller cash cushions of businesses-of-one, others suspect that it’s a lack of flexible and accessible options keeping future retirees on the sidelines. However, independent workers’ need for financial fortification does not stop at saving for retirement. While 1 in 5 independent workers say that their primary reason for saving is retirement, 1 in 3 report that their primary reason for saving is to get out of debt. Accordingly, it should come as no surprise that 68% of freelancers are using their gig economy earnings to pay off some kind of debt, ranging from student loans to medical bills.

Looking ahead, there is a clear need for financial services applications that marry individuals’ personal and professional profiles to automate real-time savings and capital allocation decisions by leveraging actionable data. Such offerings should be neither restricted to corporate employees nor rigid in their portability. As we’ve seen across the fintech ecosystem, the future of financial services will be designed with both flexibility and functionality in mind. Today, emerging leaders like Spinwheel, an embedded application enabling intelligent consumer debt repayment, and Capitalize, a portable retirement platform, are already expanding the opportunity set for consumers navigating the money maze on their own.

- Will today’s digital main streets (i.e., Instagram, Shopify, and the expanding universe of labor marketplaces) take a page from the corporate playbook and expand their financial benefits offerings as a way to lock in stickier supply, or will the continued decentralization of financial management create opportunities for new entrants to own the end-to-end consumer experience?

- Could tax-efficient savings goals like 529 plans or Roth 401(k)s / IRAs boost the earning potential of independent workers as they hustle their way to a stronger steady state?

- And might regulatory reforms that mirror the shifting employment landscape provide incremental incentive for both employment platforms and workers themselves to invest in our nation’s financial future?

4. Insurance of All Kinds

Beyond their financial foundation, most businesses-of-one lack the safeguards to support them through life’s unexpected twists and turns. Even with government-sponsored programs like Medicaid, less than 25% of independent workers reported purchasing insurance in 2019, while 35% of freelancers deliberately chose to neglect healthcare coverage due to sky-high deductibles and steep premiums. Buying insurance has historically been a tedious, stressful, and opaque process for individual operators. With underwriting practices varying wildly, there is a frustrating degree of variability in pricing and available alternatives for even the most proactive coverage seekers. With coverage needs ranging from general liability, property and business interruption insurance to disability and health insurance, the opportunity for innovation is immense.

Through advanced analytics and tailored a la carte offerings, tomorrow’s workforce should be able to optimize their overall coverage while also saving on longer-term costs through premiums and deductibles rationalization. Flexible offerings must meet people where they are and adapt to their evolving coverage needs, geographic distribution, regulatory environments, lifestyle / family dynamics, and phases of business growth, among other factors. Today, innovators like Abound, an API provider that makes it easy to embed a broad range of benefits, and Newfront, a customizable and comprehensive risk management platform, are already broadening the base of available alternatives for businesses big and small.

- Could real-time data integration and analytics across a dynamic set of relevant variables enhance the accuracy of underwriting engines and affordability of customized offerings?

- Might public-private partnerships (PPPs) and / or growing legislative momentum provide greater incentive for risk managers to offer affordable coverage to the many millions who currently forgo insurance due to a lack of access?

- And will awareness and education campaigns be able to successfully drive demand for these historically hated products, or will disruptors have better luck entering this market through adjacent fintech or services offerings?

At Obvious, we believe that the lessons and reflections of the past 18 months will similarly transform the ways in which individuals find and do their best work—as well as the value capture opportunity for workers of all kinds. Accordingly, we’re excited about the future of portable and purpose-built benefits stacks to ensure that these workers have the support they need, regardless of their employer.

If you’re equally as inspired by transformational technology capable of bridging the benefits gap in our changing professional landscape, we’d love to hear from you.