Reimagining ESG Reporting For Startups

Introducing Obvious’ first ever World Positive Report

Obvious |

The field of impact measurement has evolved meaningfully over the past 20–30 years, most recently with PRI as an investor framework, UNSDGs as a general benchmark, and the B Labs BIA as an operator assessment. For the private sector, the tools have been developed largely with public markets and growth stage organizations in mind.

Understandably, these mechanisms don’t fully account for the challenges, opportunities, and successes of earlier stage, venture-backed companies — because early-stage startups are uniquely and singularly focused on one thing: survival.

Obvious invests in companies with impact baked into their business models, whose products and services propel their purpose — and fortunately for us, this makes both capturing and reporting their impact a relatively simple, and clear, calculation (without too much reporting burden on them).

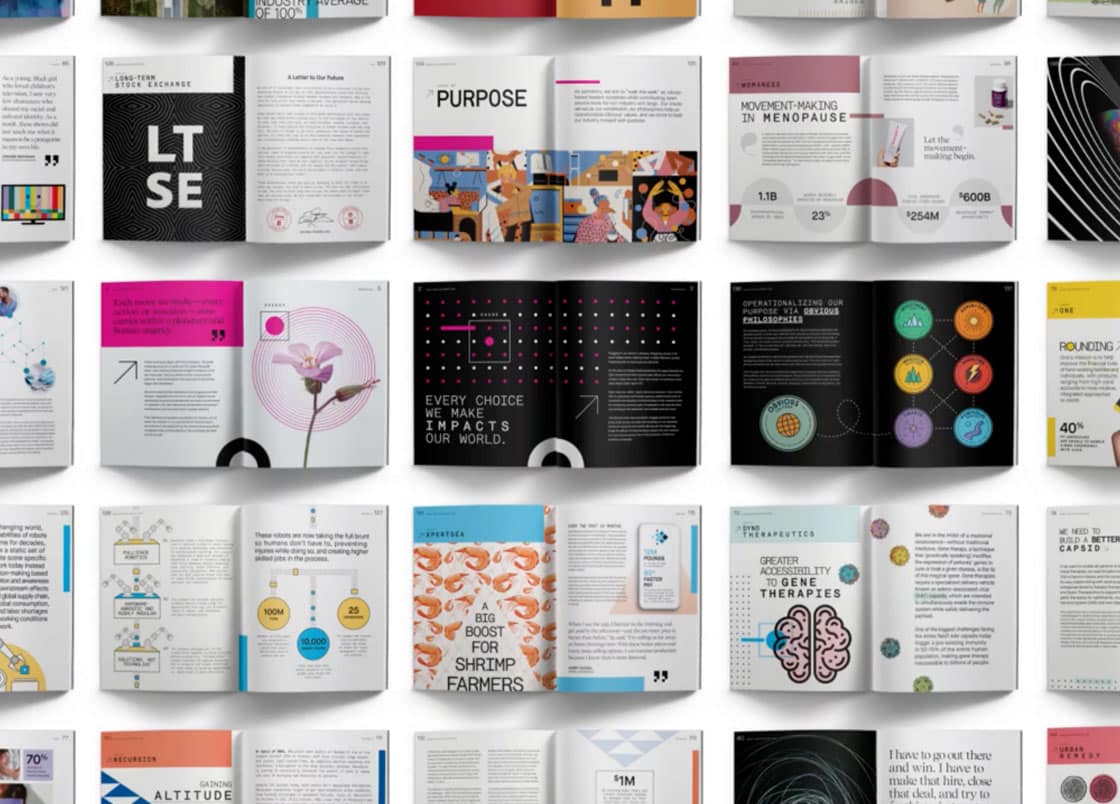

So we created our own impact report — the 2020 World Positive Report — taking both a quantitative and qualitative look at the indelible imprint Obvious portfolio companies are leaving on the world. We believe this will both elevate their stories while aiming to inspire other early-stage founders to more thoughtfully consider — and build onramps for measurement of — the impact of their endeavors as they grow.

Here’s a preview:

We are big believers in measuring and sharing stories of impact, and think this type of reporting can supplement the excellent work of B Labs and others in ways that are tailored to and engage startup founders more deeply.

Check it out and let us know what you think!