Building the SMB Central Nervous System

Verticalized tech for SMBs, a once untenable VC category, is about to have its moment

Obvious |

When I was growing up, my parents owned and operated a small golf supply company. They were immigrants from Taiwan who found a niche importing graphite from the old country that they then turned into golf shafts and sold to pro shops. I grew up in their office and started working part-time for the company when I was 13.

The business software we used seemed ancient, even for 2005. The user experiences were awful. The tools weren’t built for our business. Easy access to capital didn’t exist. Expanding our business required increasingly larger lines of credit to pay for inventory. Banks weren’t willing to offer loans to a small golf business, making growth challenging.

All these years later, things aren’t much better for small business owners – mired in highly manual workflows with generalized, outdated technology and a lack of access to capital – despite making up the backbone of the U.S. economy (32 million small businesses employ about 60 million people accounting for 40% of our GDP). Add major labor shortages, inflation, and a COVID-shifted retail reality to the equation, and it’s no surprise that nearly half of small business owners are experiencing burnout.

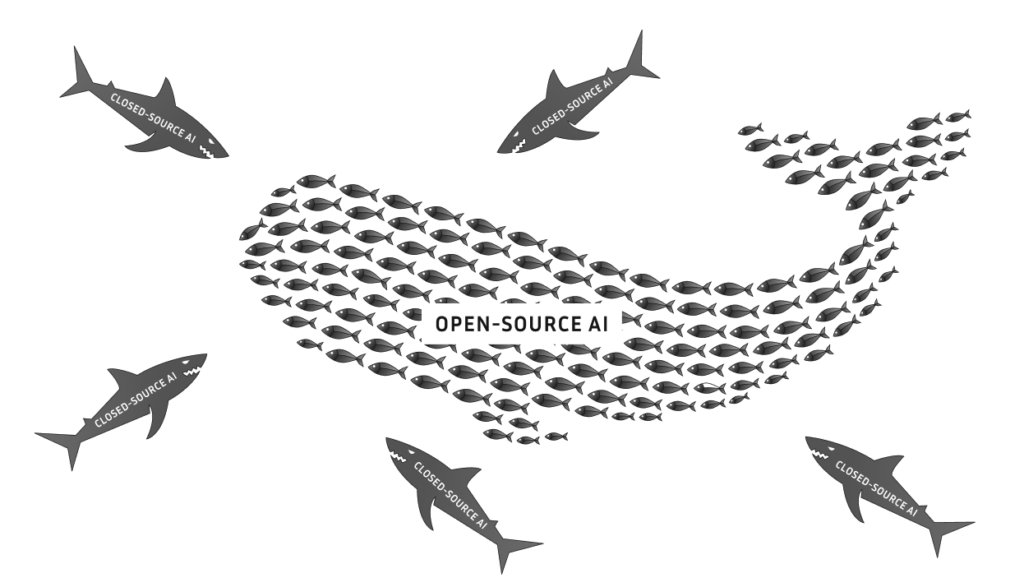

At Obvious Ventures, we invest in startups that are tackling these challenges and helping SMBs maximize their potential. We foresee the creation of a new generation of startups that act as the central nervous system for SMBs’ respective, verticalized markets. We are talking about purpose-built solutions that are designed to solve core challenges specific to the market they address, many of which are hiding in plain sight – retail, construction, manufacturing, shipping, agriculture, and more.

The Secrets of Success

Drilling into a great opportunity that realizes the full potential of a vertical market requires us to understand the key customer pain points. In interviewing founders within our portfolio, they confirmed what my parents experienced:

- Manual workflows: Highly manual workflows remain with a shocking number of businesses, where pen and paper are often the most common solution.

- Lack of support: Smaller businesses are notoriously understaffed. Business owners struggle to hire and retain employees.

- Tight cash flow: Slow payment times with suppliers, rising inventory costs, and lack of available banking options are all regular concerns for small businesses.

Companies that can solve these challenges will have the ability to capitalize on a massive opportunity, and while the steps to get there vary by market, the core foundations have already been laid out elsewhere. Here are two examples:

Shopify: Solving eCommerce

Shopify made it easy to sell online without needing to hire incremental support. Their product soon became the core operating system for businesses, owning all the product and customer information that the businesses relied on. Once they “owned” the customer, Shopify continued to build products tackling other pain points. Shopify subsequently recognized the challenges that retailers faced with payments and expanded into payment processing, which now drives the majority of their revenue.

Square: Solving checkout

Square started with a simple but important problem for restaurants and other small businesses: checkout. A combination of hardware and software unlocked payments at the point of sale and became core to their customers for running their business and collecting transaction data. Square continued to release more products to address incremental pain points for its customers. Today, Square offers an entire suite of financial services from payments to banking, lending, and payroll.

These two examples are deeply instructive for how startups might approach building products for verticalized SMBs and can be broken down into three steps.

1. Own the System

Access appears to be the key enabler. Building a central nervous system starts by addressing the first two important pain points: manual workflows and lack of support in core operations. What those workflows are will vary by category and need to be purpose-built for their market (e.g., restaurants and trucking companies run their operations much differently, and need bespoke software solutions). Whatever it is – an ERP, a storefront, a management system – it needs access even before it can own the data, something businesses today can’t thrive without.

2. Collect the Data

Once you have the system that orchestrates the primary workflows of a business, the next step is to leverage that incremental business data. Being the core system unlocks the inside view of the user journey which is key data that nobody else has access to. This is first-party data about why an end user does something and how use cases might be different across user archetypes. This is the opportunity to learn as much as possible about a market.

3. Unlock New Products

Incremental data unlocks the last key pain point: access to capital. Incremental business and customer data make financial service offerings a strong complement to the core software solution. Fintech has now become the next major expansion opportunity in these markets and modern APIs are enabling financial services to be embedded within these software stacks to uniquely drive better access, underwriting, and experience at the edge.

While we are still in the early innings of this vertical market evolution, there are scores of startups striving to become the CNS across many markets.